Are you aware of the various strategies that can significantly improve your invoicing process and expedite payment? By making a few tweaks and adjustments, you can effectively prevent disputes and potential chargebacks, resulting in a consistent flow of cash. Here are some simple enhancements you can implement to optimize your invoicing system.

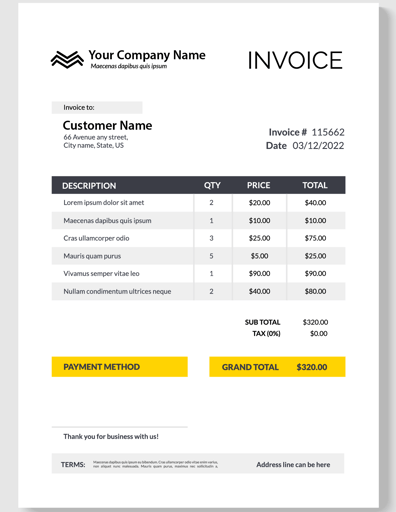

Ensure that your invoice template exudes simplicity and professionalism.

When creating an invoice, it is crucial to prioritize clarity and professionalism to avoid any potential disputes and delays in payment. Put yourself in the shoes of your customers. Would you be inclined to pay an invoice that is unclear or confusing? Not only can this lead to payment delays, but it can also harm your business relationships and future referrals. Therefore, it is essential to maintain a neat and straightforward invoice template that reflects your professionalism.

To streamline your invoicing process, you have a couple of options that can save you time and effort. One option is to utilize a TMS (trucking or transportation management system) that provides a professionally designed invoicing module. This can help simplify the process and ensure a polished and professional invoice. Keep in mind that there may be associated costs with this option. Alternatively, you can rely on your dedicated Partners Funding Account Executive to create the invoice for you. However, it's important to note that this option may also come with additional costs. If you prefer to handle invoicing on your own, consider creating a straightforward invoice template that you can use repeatedly for billing your customers. This will help maintain consistency and efficiency in your invoicing process.

- A header containing your business name, contact details, physical address, and logo (if available).

- Invoice identification number.

- An invoice date for better organization and clarity.

- Include specific information about the job or services being billed such as the details of the shipper and consignee, truck number, driver name, and any relevant reference numbers.

- Include the customer's name and billing address.

- The total amount being invoiced.

- The payment deadline*

- Include any additional information or personal message that may be relevant, along with a sincere expression of gratitude.

*To maintain a steady cash flow and ensure prompt payment, it is customary for the invoice's due date to be set within 30 days of the customer receiving it. This industry practice not only guarantees that you receive payment in a timely manner but also helps to sustain a healthy financial flow for your business.

Create invoices swiftly and accurately.

To streamline the payment process and guarantee timely payment, we have developed a comprehensive invoice requirement guide. This guide ensures that we have all the essential information and necessary documents to expedite your payment.

If you have any inquiries, don't hesitate to reach out to your dedicated Account Executive. They are always here to assist you.

Tag(s):

General Information